|

The Case for Conflict TheorySome people are born on third base and go through life thinking they hit a triple. Barry SwitzerConflict theorists believe that as class stratification developed, those who initially used power to get to the top, continued to use their power/authority, wealth and prestige to stay on top. Once the elite gain control over productive resources, they use their power to set up a system to maintain their control. Ultimately, this theory states, the rich and powerful remain rich and powerful whether or not they are the most talented people in their culture, and whether or not their actions bring any benefit to their culture as a whole. (Again, this is really an hypothesis to explain the unequal distribution of wealth, prestige, and power in industrial cultures such as the United States.) Conflict theorists, in presenting an argument against the functionalist theorists in explaining human inequality, most frequently use the United States as an example. Conflict theorists note that in the US particularly, the functionalist theory has become a secular ideology: a statement of beliefs that is based not on religion but on a specific secular world view which few bother to question. This secular ideology, according to conflict theorists, has socialized most people to believe that we as a nation are better off with wealth being unequally distributed than we would be if wealth were more equally distributed. At the core of this ideology is the belief that the rich, in a general way, deserve their wealth because of their needed contributions to society, whereas the poor deserve their poverty because they are not talented enough or hard-working enough to make a contribution. This belief, which is false according to conflict theorists, supports the rich staying rich, and maintains our culture as one where wealth is increasingly unequally distributed. Many Americans, on the low end of wealth distribution, merely question their own self-worth, and envy the rich: thus the majority of Americans rarely question the system of which they are a part. While the US has inequality on the level of many countries where there have been riots on that issue, there is little protest in the United States. The functionalist theory of social inequality has thus become the secular ideology of the United States. Like any other belief system in the US, not all people believe it...particularly conflict theorists, who say it is simply wrong. Conflict Theorists Objections to Functionalist TheoryThe first objection of conflict theorists is that inequality and the class system do not succeed in effectively placing the most qualified individuals into culturally important statuses and roles, which functionalists claim is the main socially beneficial result of inequality. In a 100-meter race, where everyone starts at the same place, in most instances the fastest person will win that particular race. The real question in American culture, according to conflict theorists, is this: given the realities of our social, political and economic life, does everyone start off at the same place? A child, born of homeless parents, abused and neglected in early childhood, has much less chance of moving into the upper class than a child born into an upper middle class home with supportive parents. The social class of birth, along with ethnicity, gender, sexual orientation, and even religion, may still offer serious impediments to economic success in America. A poor child must be extremely talented to be successful, whereas that level of talent is not demanded of middle or upper class children for them to be successful. A very talented lower class kid may indeed be able to attend college on a scholarship and do well in life. However, a mediocre or average child of upper class parents will go to prestigious schools, and because of the network of support provided by his upper class parents may go on to acquire wealth, prestige and power despite his lack of talent. (Of course he/she may also simply inherit it.) A lower class child of equally mediocre talent is unlikely to do so well, and certainly can not look forward to a large inheritance. Ethnicity and gender are still excellent predictors of social class in America, despite many many exceptions, including President Barak Obama. If indeed talent lies equally in the lower class, or among all ethnic groups and in both genders, than America is wasting much of its talent, according to conflict theorists. Check the charts below.

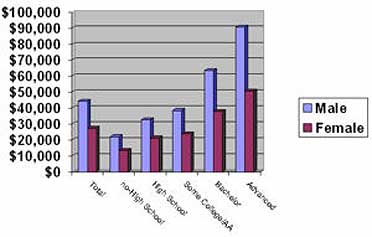

2006 Income in the United States Median income means that half the people make above that figure, and half make below that figure. (It is a different statistic than the mean or average.) This chart indicates the bottom 5% of Americans compared to the top 5%, the continued difference between males and females, as well as the continued difference between whites, Hispanics, and African Americans. The chart also indicates the advantage of a college education, so hang in there! For more specifics on gender inequity, even with college degrees, check out the chart below.

2006 Chart of Income by Gender

Education and Gender (2006)

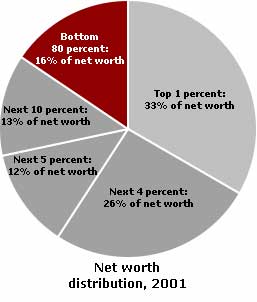

A second objection is that in American culture, financial compensation is not necessarily tied to contributions to society. In many cases, that is clearly a value judgment, because there can be lots of discussion about the worth of individual contributions. Some Americans might agree that Oprah Winfrey is worth $209 million a year to our culture. You may feel that Tiger Wood's golf talent is worth $75 million, that the rock group U2 is worth $195 million, while Lady Gaga is worth less than half that at $90 million. (Data from Forbes Magazine, and represents the 12 months from May 2010-11. Click here for celebrity salaries, and sort list by "money rank", second column at left .) In looking at the pay of non-celebrities, including the richest 400 Americans as of September 2011, one might also question as to whether or not our society awards people for their hard word and for the contributions they make to our culture. Bill Gates, at a net worth at that time of $59 billion (not his annual salary), heads the list, and you may think deservedly so. Five heirs of Sam Walton (founder of Walmart and Sam's Club) have made the list of the top 30 as well, plus three who made their fortunes ($13.8 billion each) from Mars candy bars. Brothers Charles and David Koch (in the news recently for their contributions to the Wisconsin governor and his public employee union busting campaign), are tied for #5 with $25 billion each. It is up to you to decide if their contributions are worth it to America. Click here for the entire list. Other jobs that also take ability and hard work, such as nursing, pay much less, and are presumably less important for society than making Mars bars or hitting golf balls, according to functionalist theory. In 2007 the median income for registered nurses in the United States was approximately $60,000. (Median income means exactly half the R.N.'s in the country made more than this, and half less.) In 2007, the average pay for nurses (RN's) in Hawaii was $74,220, the third highest state in terms of nurses salaries, according to the US Dept. of Labor, Occupational Employment Statistics. A third objection is that while rewards of wealth, prestige and power/authority do indeed motivate people to work hard, it is difficult to say how much inequality is needed to motivate people. Conflict theorists would say our current level of inequality makes no sense. There are many ways to look at the United States and the unequal distribution of wealth. One is net income, which was presented in the first chart. Another way is the concept of net worth, that is, how much wealth the individual would have after all their debts were paid, essentially subtracting all debt from the value of all assets including home, car, and other personal possessions, stocks, savings, etc. The bottom 80% of the population has a mere 16% of the net worth in the US. In actual fact of course, for many Americans their debts amount to more than their assets, and they have no net worth.

Looking at the concept of net worth historically, between 1983 and 1998 the bottom 40% of the population saw their net worth decrease 76.3%. All other groups saw their net worth rise, but the richest 1% of the population saw their net worth increase by over 42%. I have already noted (see lesson on human inequality) that recent 2010 statistics show that in terms of earned income, the rich are indeed getting richer in the US, with the top 20% of the people collecting almost 50% of the earned income in the US, with the bottom 20% collecting less than 4%. Conflict theorists would say that this level of income disparity is proof that the wealthy manipulate the system to stay wealthy; it brings no benefit to the majority of Americans. Below is another chart indicating that while median income in real dollars has stayed remarkably the same since 1917 (remember median income means that half of all Americans make more, and half less) the income of the top 5% of Americans has continued to climb dramatically, and since 2008 is once again climbing.

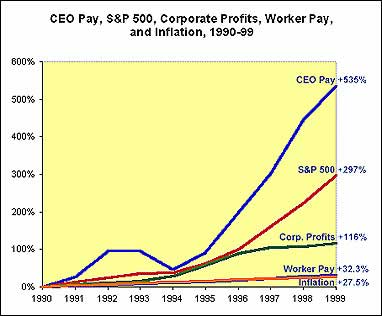

CEO's, or Chief Executive Officers, are indeed talented and generally hard-working people, and run the major companies that employ many Americans. Presumably, each CEO is worth more to their culture than a typical worker? How much more should CEO's be paid than their workers and supervisors? In much of Europe and Japan, CEO's are paid only 10-20 times what the average worker makes. In the US in 2007, it was 364 times; by 2009, mid-recession, it had dropped to 263 times what the average worker made. The top 20 CEO's in the US were paid an average of $36.4 million in 2007; in Europe, the top 20 CEO's were paid an average of #12.5 million, or about 1/3 as much. While as noted, CEO pay has decreased since 2007, it is still 263 times what the average worker makes. Look closely at the following two charts.The first compares the percentage rise in CEO salary to worker pay between 1990 and 1999, pegged to corporate profits, the S & P Stock index, and inflation. While worker pay did slightly better than inflation, increasing over 32%, CEO pay increased 535%.

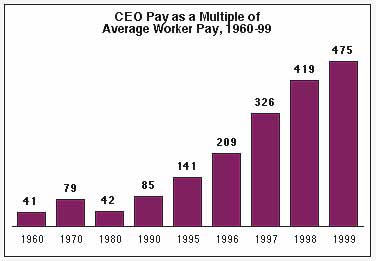

The chart below shows what has happened to CEO pay as a multiple of worker pay from 1960-1999. In 1960, the average CEO made 41 times what the average worker made; by 1999, CEO's made an astounding 475 times what the average worker was paid.

Recent scandals involving fraud by some of these same CEO's would tend to support the view of the conflict theorists: that the rich simply use the wealth and power to get richer and to stay in power. However, these same recent scandals, as well as the economic downturn in US economy, have decreased CEO pay as a multiple of worker pay. In 2001, the average US worker made $26,764, while the average CEO made $11 million, so that the CEO made only 411 times what the worker made. By 2007, as noted, the average CEO made a mere 364 times what the average worker made, though in 2009 it dropped to 263 times, somewhere between the 1996 and 1997 averages. Recently, due to the 2008-2010 recession, executive pay and bonuses has come under increasing attack, particularly since many Americans believe that in the financial area, the same executives who made the highest pay/bonuses are responsible for the current recession. As part of the most recent bailouts, the government has said that CEO pay for companies that have accepted federal bailout money will be capped at $500,000. Many Americans now seem to agree that this amount would be sufficient motivation; as noted in the previous lesson on "The Case for Functionalist Theory", not all agree. [Click here for brief article which presents both points of view.] It is interesting to note that in 2009, a CEO of a Standard & Poor’s (S&P) 500 index company was paid, on average, $9.25 million in total compensation (this usually includes salary, bonuses, and other "perks"). As most of you know, during 2009 millions of Americans lost their jobs, their homes and their retirement savings. In 2009, in Hawai'i, the average CEO compensation was almost $2.5 million annually (the CEO of Alexander and Baldwin, who received $5.3 million, was the highest paid). For 2008, the average annual income for ALL occupations in Hawai'i was $41,630. Again, the question focuses on what is sufficient motivation for the skilled and hard-working. [Click here for a corporate watch site that tracks company CEO salaries, by average worker salaries, as well as a variety of other information.] The Obama administration appointed a "pay czar", who to rule on CEO salaries for those banks and auto companies that accepted bail-out loans from the federal government. The CEO of Bank of America decided to work for free for this 2010, and the CEO of Citgroup stated he will work for $1 a year until the company returns to profitability. Of course, many of the banks that accepted bail-out loans have paid back the money and no longer are under any federal supervision. The 2009 Michael Moore film Capitalism: A Love Story, often clearly states the conflict theorists viewpoint. (For more on the "pay czar", including a short video, click here.) It may be that the level of inequality in the United States is finally moving a few people to protest. Warren Buffet, the second richest American at $39 billion, has urged his fellow billionaires to help him lobby for a change in the tax laws, to raise the taxes on the richest Americans. Buffet noted that very wealthy Americans such as himself earn much of their money via capital gains, taxed at a mere 15% rate; as a result, he noted that he pays taxes at a lower rate than his secretary. In the US, an individual making more the $34,000/year pays 25% of it to taxes; an individual making $83,600 pays 28% of it to taxes. (Click here for his Aug. 2011 article.) This has become a major political issue for the upcoming elections. And the current "Occupy Wall Street" movement appears to be a protest against income inequality, among other things. The United States is the richest country in the world, has the richest lower class, and has some of the greatest inequality between rich and poor. This last has certainly created certain social problems. Whether or not the increasing inequality in wealth distribution was necessary in order to increase our culture's wealth depends upon which viewpoint you find most convincing. Whether or not the solution to the current financial crisis is to accept a view more in keeping with conflict theory, which would impose limits and regulations (or at least tax the rich more), or if we should return to the unregulated financial markets of 2000-2007, again depends upon which theory you find more convincing.

|